CIOTechOutlook >> Magazine >> December - 2015 issue

Adopt Cloud First principle to host Peripheral Systems

By

DHFL(BSE: 511072), headquartered in Mumbai, is a housing finance company that provides home loan products, insurance services and fixed deposit schemes. The company provides housing finance to the lower and middle income groups in India.

DHFL(BSE: 511072), headquartered in Mumbai, is a housing finance company that provides home loan products, insurance services and fixed deposit schemes. The company provides housing finance to the lower and middle income groups in India.India is at the threshold of a Digital revolution. Today, social media, Mobility, Analytics, Cloud and many other digital technologies are shaping the way people and organizations (including the government) interact with one other.

Two specific technologies that Insurance companies are currently viewing with interest and/or adopting, include Cloud and Mobility. Analytics is also important, but in my scheme of things, it follows the two.

Cloud – A true leveller

Cloud has made availability of cutting edge/ best-of-breed solutions possible for Insurance companies irrespective of their scale or size or stage of evolution. Smaller companies have been the biggest gainers, given that they can now access best solutions at a very reasonable cost. Companies are less hesitant to experiment and are deploying new solutions/technologies without a significant risk of failure.

While the regulator bars insurance companies from hosting core systems on the Cloud, the peripheral systems which are equally important for running insurance operations such as Collaboration solutions, Human Resource applications, Training, Active Directory, Antivirus and Procurement Systems etc. are being hosted on Cloud on SaaS, IaaS, BPaaS mechanisms etc. Insurance companies are also opting for public, private or hybrid Cloud. It frees up the IT function of the organization, which can then focus on more value-add activities rather than on BAU activities like uptime, capacity management and technology obsolescence.

I strongly believe that the Cloud strategy for any organization should be holistic. Organizations need to be ready to commit themselves to Cloud and regulations permitting, should adopt a Cloud First principle.

While making a Cloud decision for the organization, it is also very important to look at how all the IT systems - hosted in-house, hosted on private Cloud and hosted on public Cloud - interact and talk to each other so that islands of information are not created. Most often, the service providers try and sell one application or service on Cloud. They do not really review the organization’s IT landscape and provide a holistic recommendation based on how well the new offering will fit in and add value to the existing IT set up.

Cloud is all about pay as you use, there are lock-ins and there are disruptions when the workload is transferred from one service provider to the other so please plan and prepare yourself for the same

Mobility – a game changer

Customers want convenience. They want to interact with companies via a medium of their choice, and at a time and place of their choice. Mobility ensures that the customer has a multi-media device with internet access and ability to make instant decision anytime anywhere. The high penetration of mobile phones has provided insurers a better, faster and cheaper medium to engage with existing customers/ distributors as well as prospects.

Insurance companies want business growth and satisfied customers & distributors. They want to offer the right value proposition to prospects and robust support services to existing customers to keep them engaged and satisfied. With Mobility, they can improve sales capabilities and improve service levels.

Most commonly, mobiles are used to support the sales teams by providing them access to information anytime, anywhere so that they can close business easily. Insurers also use this medium to provide customer services such as current policy related information, timely alerts and updates and premium payment solutions. Few companies have also launched mobile apps for need analysis, product comparisons, illustrations and premium calculations.

While company specific apps help to improve customer and distributor services, and increase operational efficiencies of that particular company, the reality is that most customers own multiple policies, whether life, health or general. And these are not necessarily from the same insurer. Given the scenario, downloading and operating individual apps can become cumbersome for many.

Looking forward, I see the emergence of mobile applications that will serve as a digital wallet for insurance (financial services). Customers will be able to access all their policies by downloading one single self-service app. These I believe, will be the true financial advisor cum service partner for a customer.

Most insurers have already started adopting Mobility. Those that haven’t should wake up to the reality that mobile phones are not just the currently preferred, but also the future communication medium of choice. Providing convenient self-service, easy to use apps that will keep customers engaged and satisfied is the only way forward.

CXO Insights

Artificial Intelligence A Boon Or Bane?

By Moqierish Tak, Co-Founder, India Assist

The Changing Role Of "Software And Software...

By Kris Puthucode, CEO & Principal Consultant, Software Quality Center LLC.

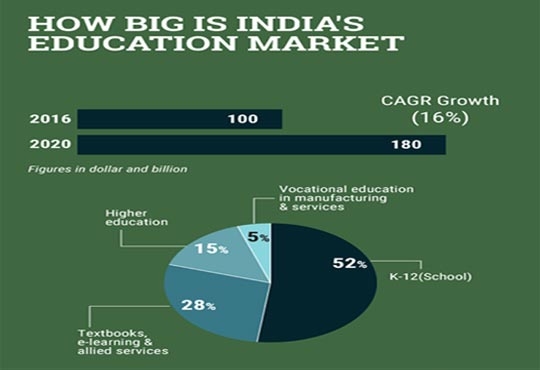

Current Industry Trends In Education