10 Reasons Why Your Current Car Insurance Can be Invalid

cioreviewindia Team | Wednesday, 29 September 2021, 05:14 IST

Owning a car is a dream and a life goal for most of us. Once we start earning, we can work towards realizing this dream. After purchasing a car, it is crucial to take extra precautions to protect it from any untoward incidents. One of the best ways to ensure that your four-wheeler is protected from the financial effects of an accident, theft, or any other adverse event is by buying a car insurance policy.

Owning a car is a dream and a life goal for most of us. Once we start earning, we can work towards realizing this dream. After purchasing a car, it is crucial to take extra precautions to protect it from any untoward incidents. One of the best ways to ensure that your four-wheeler is protected from the financial effects of an accident, theft, or any other adverse event is by buying a car insurance policy.

An insurance policy for your four wheeler four-wheeler insurance plan is an instrument that has been designed to protect your vehicle from the impact of unfortunate events. Therefore, insurance for your four wheeler provides you with financial protection if something happens to your vehicle. However, it is important to select an insurer with a decent claim settlement ratio to ensure you get the coverage you need for your car.

For instance, Tata AIG, one of the country's leading insurance providers, has an excellent claim settlement ratio. If you are planning to purchase a TATA AIG car insurance policy, you must assess the TATA AIG car insurance claim settlement ratio. It will help you understand the chances of a car insurance claim being successfully settled.

Why Your Current Car Insurance Policy Can be Invalid

While the insurer you select does play an important role in the claim settlement process, your car insurance policy and its coverage are also significant factors in this process. The selected insurer can reject a claim filed on an invalid car insurance policy.

For instance, if you purchase a second-hand car without transferring the car insurance policy to your name, then you shall not be allowed to file any insurance claims on that policy. Therefore, it is important to follow the purchase of a second-hand car with the transfer of its insurance policy.

You must monitor the validity of your car insurance policy and renew it on time. Lapsed policies are of no use in the context of providing you with car insurance coverage or enabling you to file a car insurance claim. You can carry out an online renewal of your car insurance policy.

- Car inspection:

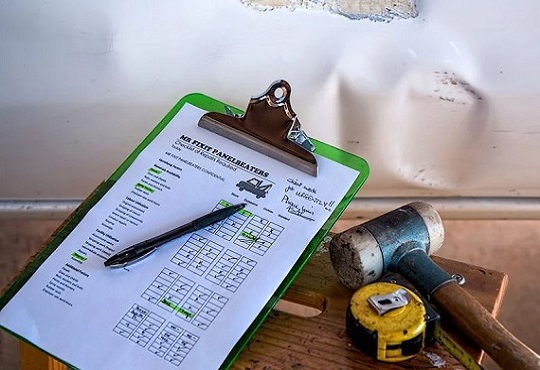

There are certain situations wherein car inspection can be a compulsory process for finding out your vehicle's eligibility for an insurance plan. Some insurers advise that you get your car inspected during the policy purchase and renewal process. If your car inspection fails to satisfy the criteria set by the selected insurance provider, your car insurance policy may get invalidated.

- Default in premium payments:

It is important to make the premium payments on time for your car insurance plan to stay valid. Completing the premium payments on time before the insurance plan expires can help you earn an NCB (No-Claim Bonus) on your policy and claim discounts on policy renewal. Usually, companies offer a grace period of certain days for premium payments post the due date.

You can use the grace period to compensate for payment failures caused by unavoidable circumstances or delays. However, if you repeat the process of not making the premium payment on time, it can lead to policy invalidation and, eventually, claim rejection should you file one.

- False claims:

Insurance plans are structured to help car owners protect their vehicles. However, if you file a claim on false grounds and the insurer discovers the fact, you risk your policy becoming invalid. Along with this, there is also the risk of legal charges that you will have to pay for fraud and concealment of material information.

- If your vehicle is used for commercial purposes:

The use of a passenger vehicle for commercial purposes or business is not covered in the insurance policy for a four wheeler. If your vehicle is used for any commercial purpose and gets damaged in the process, the corresponding insurance claim may get rejected.

- Hiding information about modifications in the car:

If you have made certain modifications to your car, you need to reveal these changes to your insurer as per the timelines mentioned in your car insurance policy. The failure to disclose the aforementioned modifications to your insurer in time may lead to claim rejection.

Just like there are reasons that can cause a car insurance policy to become invalid, there are certain reasons that can lead to a car insurance claim becoming invalid. Some of these reasons have been discussed below.

- Expired car insurance policy:

A four-wheeler insurance claim can be successfully settled only when you have a valid and active car insurance policy. If your insurance plan expires and you forget to renew it on time, your insurer can reject your insurance claim.

Furthermore, driving with an expired car insurance plan is a violation of the laws prevailing in India. Therefore, it is important to renew your auto insurance before the plan expires. You can complete your car insurance policy renewal online by following a quick and easy procedure.

- Running from the location of an accident:

Parties involved in accidents usually give in to panic and make the mistake of running away from the scene of an accident. During the process of inspecting an insurance claim, the relevant insurer or their agents inspect the accident spot and the vehicle in its entirety.

Therefore, if you run away from the accident spot and subsequently file an insurance claim, that claim may get rejected.

- Including false details in the insurance claim:

It is important to provide the correct and accurate information about your insurance plan in an insurance claim. The submission of false information can lead to claim rejection.

- Non-compliance with the law:

If you are found to have broken any laws during an accident, for instance, driving a vehicle while intoxicated or going over the speed limit, your insurance claim might get rejected.

- Not following your insurer's claim process:

Every insurer has a specific insurance claim process, and if you fail to follow their method of filing the claim, the insurer may consider it an act of non-compliance and reject the claim. Therefore, it is essential to learn about the insurer's claim settlement process and follow it diligently while filing a claim.

Conclusion

You must follow certain preventive measures to avoid your insurance claim from getting rejected. However, your insurance company will accept your claim as per the coverage mentioned in the insurance plan if you file the claim for the right reasons and by following the prescribed procedure.

Therefore, driving your vehicle safely and conducting the car insurance policy renewal on time is important. Many insurers also allow policyholders to conduct an online renewal of car insurance to make the process hassle-free for them.

CIO Viewpoint

Insurance Tech Trends: Moving from Brick to...

By Dheepak Rajoo, Chief Information Officer, Royal Sundaram General Insurance

Easing the access to insurance with...

By Ayan De, Chief Technology Officer, Exide Life Insurance

Does an Organization's Digital Journey Warrant...

By Mudit Agarwal, Global IT Head, Uflex

CXO Insights

Significance of Customer-centric Digital...

By Janifha Evangeline

How tech will shape insurance operations in...

By By Ayan De, Chief Technology Officer, Exide Life Insurance

Transforming the Insurance Sector with Low Code

.jpg)

.jpg)